Health is everyone’s right. Help us cancel inequalities.

Health is everyone’s right. Help us cancel inequalities.

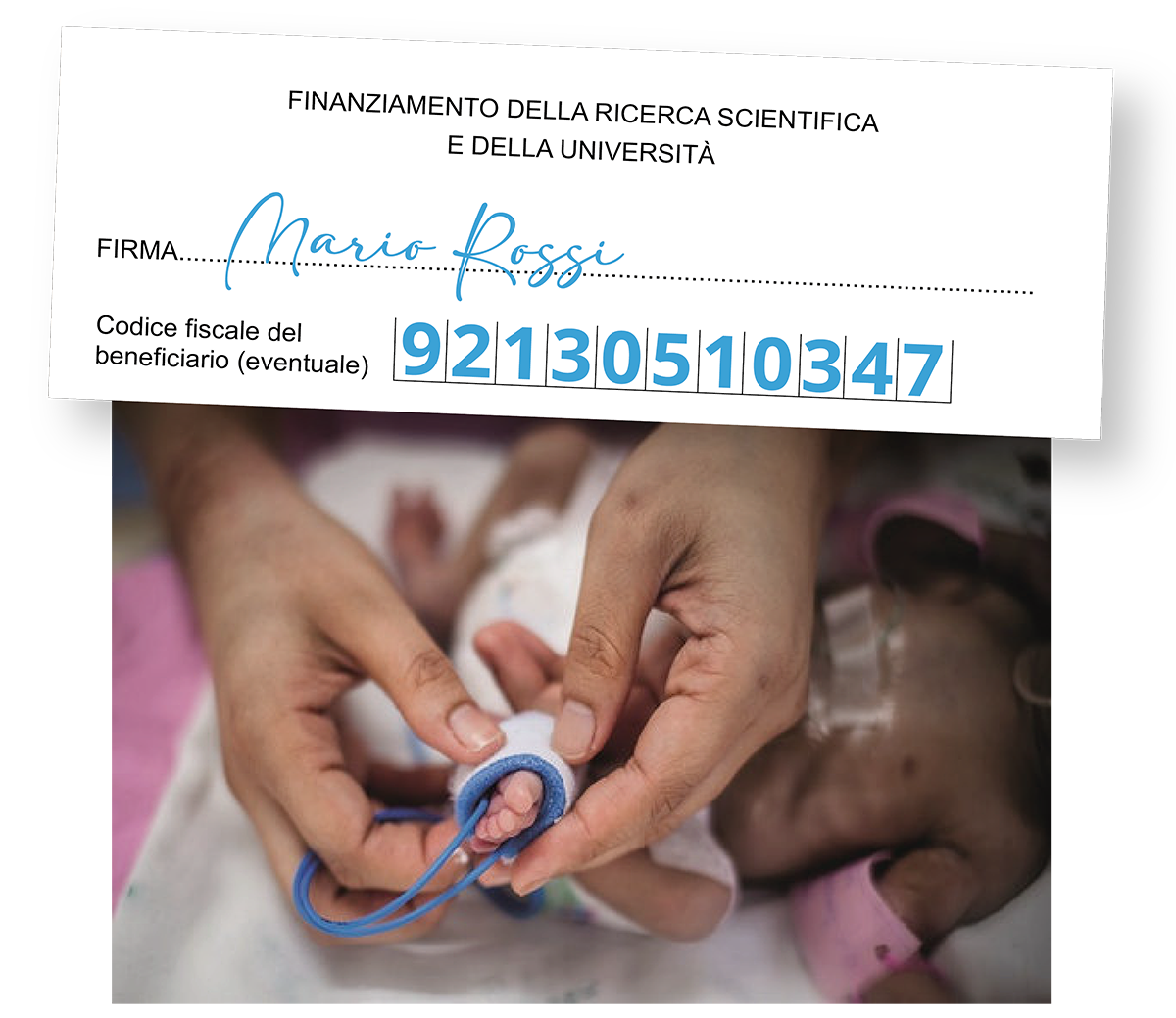

Donate your 5×1000 to the Chiesi Foundation: simple, easy, and free

In your next tax return, indicate the tax code 92130510347 to support the projects that Chiesi Foundation has been carrying out for 20 years in the fields of scientific research, training and international cooperation in low and middle income countries.

92130510347

Find out how much your signature is worth

Enter your gross annual income data for the previous year

IRPEF Tax

Your 5×1000

The calculation of the IRPEF tax and 5×1000 is indicative; it does not take into account any tax credits, deductions, allowances, or withholdings. To find out the exact amounts, contact a CAF or an accountant.

Donating 5×1000 to Chiesi Foundation is simple:

1

FIND the space dedicated to choosing the destination of 5×1000 of the Irpef in your Income Tax Return (CU, 730 or Modello Redditi Persone Fisiche)

2

SIGN in the box “ Financing of scientific research and universities ”

3

ENTER our tax code 92130510347

What we do with your 5×1000

The 5×1000 will turn into concrete help to support our projects. For example, an annual gross income of € 30,000 generates a 5×1000 of € 38 which will be used to carry out scientific research and programs in the countries where it is most needed.

Scholarships for scientific research.

Purchase of professional medical machinery.

Continuous training of medical and nursing staff.

Find out more about our Social Report

Financial resources and use of funds

Releases 2023

| Scientific research and knowledge dissemination | €200,695.00 |

| International Cooperation | €448,172.98 |

| Total disbursed for institutional activities | € 648,867.98 |

| Personnel expenses | €235,770.93 |

| Administrative and organizational expenses | €88,707.77 |

| Total outgoings | €973,346.68 |

Revenue 2023

| Chiesi Pharmaceuticals SpA | €518,102.92 |

| Valline Srl | €150,000.00 |

| Chiesi Italia SpA | €6,028.47 |

| Total donations | €674,131.39 |

| 5×1000 (2021) | €67,603.84 |

| Other income | €77,155.25 |

| Total revenue | €818,890.48 |

Contributions, subsidies, support received from public administrations and similar bodies in the year 2023

| Dispensing body | Ministry of Finance |

| Nature of disbursement | 5X1000 of IRPEF (year 2021) |

| Amount disbursed | €67,603.84 |

| Delivery date | 12/12/2023 |